Let’s be honest—insurance can sound a bit boring… until you actually need it. One unexpected event, a car crash, a medical emergency, or even a flight cancellation, and suddenly, insurance becomes the most important thing in the world.

But here’s the problem: most people don’t really understand how insurance works or which type they even need. That’s totally normal—insurance comes with its own confusing terms, endless fine print, and more policy options than your favorite streaming service.

That’s why we created this guide.

In this article, we’re breaking everything down for you in simple, everyday language. We’ll start by explaining what insurance actually is and why it matters more than you think. Then we’ll walk through how it works, the main types of insurance, and what to watch out for before signing any papers. You’ll also get a quick look at insurance principles, tips on how to choose the right policy, and a cheat sheet of common terms so you won’t feel lost when talking to an agent.

Plus, we’ve got a handy FAQ section at the end to answer the most common questions people ask—and we’ll wrap it all up with some helpful final tips.

So, whether you’re completely new to insurance or just want to make smarter decisions, you’re in the right place. Let’s dive in! massalarabiy

Table of Contents

What Is Insurance?

Consider insurance as your financial safety net. It’s a contract between you and an insurance company designed to protect you, your family, or your business from unforeseen events such as accidents, illnesses, natural disasters, or property damage. By paying regular premiums, you ensure that if something goes wrong—be it a car accident, a fire, or a medical emergency—the insurance company will cover the costs or reimburse you according to your policy’s terms. The challenge is that you’re investing in something you hope you’ll never need. However, if the worst occurs, having insurance can be the key difference between recovery and financial ruin.

Why Is Insurance Important?

Let’s be real—life doesn’t always go as planned. That’s why insurance matters more than most people think. It’s not just about paperwork or monthly payments—it’s about having a safety net when life throws you a curveball.

Whether it’s a medical emergency, car accident, natural disaster, or even a sick pet, insurance helps cover the costs so you’re not left struggling. It protects you, your loved ones, and your assets from unexpected expenses by transferring that financial risk to your provider in exchange for a monthly premium. More than that, it gives you peace of mind. Knowing you’re covered means you can live your life with fewer worries, knowing that if something goes wrong, you’ve got support, stability, and security to fall back on—even for your family, if you’re no longer around. Among the most prominent benefits of insurance are:

- Protecting an individual’s future from risks that could threaten his financial stability by avoiding the potential huge loss if he does not have any insurance against the risks he may face.

- Insurance studies the causes of risk, develops solutions, and takes appropriate measures to avoid and address each type of risk, providing security, prevention, and insurance for individuals and companies alike.

- It contributes to maintaining the production capacity of facilities.

- Life insurance helps a person’s family after his death, as it helps him save money through the premiums collected by the insurance company.

- It’s easy for people to obtain loans from banks, as most banks will not grant loans to people who don’t have life insurance, as they will not be able to repay the loan after the borrower’s death.

- Achieving the principle of joint cooperation between a number of people exposed to the same risks, and ensuring the stability of their future by sharing in bearing the risks they may face.

- It instills reassurance in people’s souls.

- Insurance contributes to a country’s economic development through the loans it provides to companies and individuals. Insurance provides significant benefits to the national economy through insurance companies investing their accumulated premiums in public and private projects.

- It compensates for losses that may be incurred by establishments due to any risk that occurs, which contributes to preserving the wealth of these establishments.

How Does Insurance Work?

So, how does insurance actually work? It’s pretty simple when you break it down. You pay your insurance company a regular fee—called a premium—and in return, they’ve got your back if something goes wrong. That “something” could be anything from a car accident to a flooded basement, a trip to the doctor, or even a canceled wedding. Once your policy is active, you’re covered for whatever’s listed in the agreement. Sometimes, you might need to pay a certain amount out of pocket first (called a deductible) before the insurance kicks in.

Now here’s the behind-the-scenes part: when you pay your premium, that money goes into a big pool along with everyone else’s. The insurance company manages this pool, and when someone files a valid claim, the money to cover it comes from there. It’s like a giant rainy day fund that everyone contributes to—just in case. And with the unpredictability of life—whether it’s a tornado, a kitchen fire, or a fender bender—insurance companies have to stay financially strong to make sure they can help when their policyholders need them most.

Whether you’re an individual looking for health or car insurance, or a business needing protection from industry-specific risks, there’s almost always a policy out there to match your needs. There are even policies for things like identity theft or event cancellations—basically, if there’s a risk, there’s probably insurance for it.

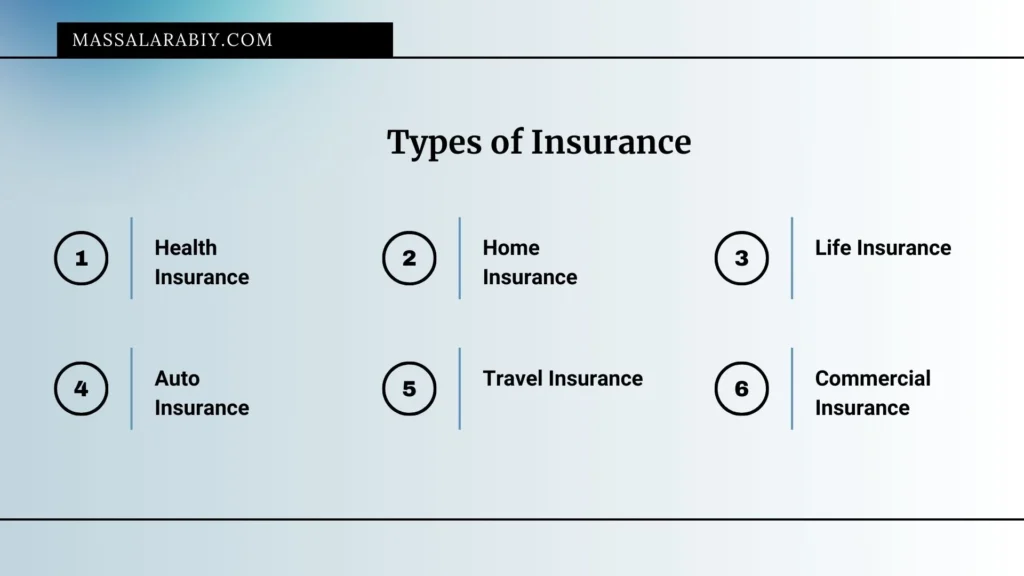

Main Types of Insurance:

The most prominent types of insurance are:

Health Insurance:

Health insurance assists in covering medical costs such as routine doctor visits, emergencies, hospital stays, surgeries, and medications. In some instances, you can also include vision and dental coverage. You can obtain health insurance through an insurance company, your employer, government programs like Medicare or Medicaid, or the federal Health Insurance Marketplace. Although the federal government no longer mandates health insurance, certain states, like California, may impose a penalty for not having it. Additionally, be aware that in addition to the annual deductible, you may need to pay copays or coinsurance; however, many preventive services are typically covered at no cost.

Home Insurance:

Homeowners insurance, often referred to as home insurance, provides protection for your house, other structures on your property, and your personal belongings against events such as fires, natural disasters, accidents, theft, and liability if someone is injured on your property. However, it typically does not cover floods or earthquakes unless you purchase additional coverage. Your lender or landlord will likely require you to maintain this insurance, and if you fail to make payments, your mortgage company may obtain a policy on your behalf and charge you for it. You also have the option to add extra coverage, known as riders, for specific situations or valuable items, though this will result in a higher premium.

Life Insurance:

Life insurance is essentially a financial safety net for your loved ones—such as your spouse or children—providing them with a sum of money in the event of your passing. In exchange, you pay regular premiums during your lifetime. This coverage can help with expenses like funeral costs, outstanding debts, and ongoing financial support for your family.

There are two primary types of life insurance: term life insurance, which provides coverage for a specified period, such as 10 or 20 years, and permanent life insurance, which remains in effect for your entire life as long as you continue to pay the premiums. Some policies may also offer benefits while you are still alive, such as payouts upon reaching a certain age or in the event of a disability, depending on the terms of your contract with the insurance provider.

Auto Insurance:

Auto insurance helps cover expenses in the event of a car accident, including damage to other people’s property, injuries, and repairs to your own vehicle. It also provides protection if your car is stolen, vandalized, or damaged by events like storms or collisions with animals.

Instead of paying for these costs out of pocket, you pay an annual premium, and the insurance company handles most of the covered expenses. If you are leasing a car or have financed it with a loan, your lender will likely require you to maintain insurance. If you fail to do so, they may purchase a policy on your behalf and add the cost to your bill. Additionally, in many areas, having auto insurance is a legal requirement. Read More: Auto Insurance.

Travel Insurance:

Travel insurance is designed to protect you from unforeseen issues during your trip, such as trip cancellations, flight delays, medical emergencies, injuries, lost luggage, or even arranging your return home in the event of a serious accident or death while abroad. It can also extend to cover rental cars or vacation homes, whether you’re traveling alone, with friends, or with family. However, be aware that most travel insurance policies do not cover extreme sports injuries, weather-related delays, terrorism, or pandemics, so it’s important to review the specifics of your coverage before you travel.

Commercial Insurance:

Commercial insurance, often referred to as business insurance, safeguards your business against unforeseen events such as lawsuits, accidents, theft, natural disasters, and incidents like fires or interruptions in operations. This insurance can cover a wide range of aspects, including your physical assets—such as buildings and equipment—as well as legal liabilities, employee claims, and financial losses resulting from operational disruptions. Since each business has unique needs, you can select coverage options that address your specific risks, whether that involves protecting your property, managing legal expenses, or ensuring your business remains viable during challenging times. Ultimately, the goal is to ensure your business can continue to operate even when unexpected challenges arise.

How to Choose the Right Insurance Policy?

When selecting an insurance plan, it’s important to evaluate your individual needs and circumstances. Begin by identifying the types of coverage you need and the extent of that coverage. Take into account factors such as your health, the value of your property, your dependents, and your budget. Next, research and compare different insurance providers, looking at their plan options, costs, coverage limits, and any additional benefits they may offer.

If you require further assistance, consider consulting an insurance professional or agent who can help clarify your options. If you are enrolling in a policy through your employer, don’t hesitate to contact your company’s HR department for support.

Insurance Principles:

Insurance principles are the core concepts and guidelines that shape the functioning and practices of the insurance industry. They establish a framework for insurers, policyholders, and regulators to promote fair treatment, manage risks, and maintain financial stability in the insurance market. These principles are categorized into technical principles and legal principles.

Common Insurance Terms You Should Know:

- Premium: The payment made by policyholders to the insurer in return for coverage.

- Deductible: The amount that policyholders are required to pay from their own funds before their insurance coverage begins.

- Policy Limit: The highest amount an insurance policy will cover for eligible losses or damages.

- Claim: A formal request submitted by the policyholder to the insurer for compensation related to covered losses.

- Underwriting: is the process of assessing risks and establishing the terms and conditions of an insurance policy.

FAQS:

What is insurance?

Insurance is a social system designed to establish a reserve that addresses potential financial losses by redistributing risk from multiple individuals to a single individual or group. Essentially, it aims to lessen the uncertainty associated with financial losses by shifting the responsibility of risk.

What are the types of insurance?

There are several main types of insurance, including private insurance, social insurance, personal insurance, and general insurance.

What is social insurance?

Its goal is to protect individuals whose livelihoods rely on their ability to work from risks that could hinder their capacity to do so, including illness, disability, old age, death, and unemployment.

What is meant by private insurance?

It is a type of insurance that an individual purchases for personal benefit, safeguarding themselves against a particular risk.

What are insurance premiums?

The premium serves as the main source of income. It represents the amount the insured must pay under the insurance contract established between both parties. In return, the insurer is required to provide the insurance payout to the insured or their beneficiaries when the insured risk materializes.